december child tax credit increase

Part of the American Rescue Plan passed in March the existing tax credit an advance payment program of the 2021 tax return for people who are eligible increased from. This means a payment of up to 1800 for each child under 6 and up to 1500.

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Increased to 9000 from 6000 thanks to the American Rescue Plan 3000 for each child over age 6.

. Families who sign up will normally receive half of their total Child Tax Credit on December 15. Total Child Tax Credit. Eligible families who did not opt out of the monthly payments are receiving 300.

This is up from the 2020 child tax credit. Under the new child tax credit provisions eligible parents received 3000 for children aged 6 to 17 and 3600 for children aged 5 and younger. The American Rescue Plan Act of 2021 raised the amount of the child tax credit to 3000 per child or 3600 per child under age 6.

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. The child tax credits are worth 3600 per child under six in 2021 3000 per child aged between six and 17 and 500 for college students aged up to 24. Read Policy Brief.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. The maximum Child Tax Credit increased to 3600 for children under the age of 6 and to 3000 per child for children between ages 6 and 17. We explain how parents can boost the value of their child tax credits for December Credit.

The child tax credits are worth 3600 per child under six in 2021 3000 per. Eligible families who did not opt out of the monthly payments are receiving 300. The credits were at least.

3600 for children ages 5 and under at the end of 2021. The credit for qualifying children is fully. Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis which accounts for half of the.

The Child Tax Credit provides money to support American families. The Center on Poverty and Social Policy at Columbia University said that the child poverty rate rose from 12 percent in December 2021 to 17 percent last month an. The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and 500 for college students aged up to 24.

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. The Child Tax Credit reached 612 million children in December 2021 an increase of 2 million children over six months from the rollout to 593 million children in July. And 3000 for children ages 6.

Here is some important information to understand about this years Child Tax Credit. For children under 6 the amount jumped to 3600. Between July and December 2021 the Internal Revenue Service paid out six months of advance Child Tax Credit payments worth up to 250 per child aged 6.

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. The Child Tax Credit reached 612 million children in December 2021 an increase of 2 million children over six months since the rollout to 593 million children in July.

Child Tax Credit When Where Will December Payment Be Sent Mcclatchy Washington Bureau

Expanded Child Tax Credit Available Only Through The End Of 2022 Cbs Los Angeles

The Child Tax Credit Research Analysis Learn More About The Ctc

Parents Guide To The Child Tax Credit Nextadvisor With Time

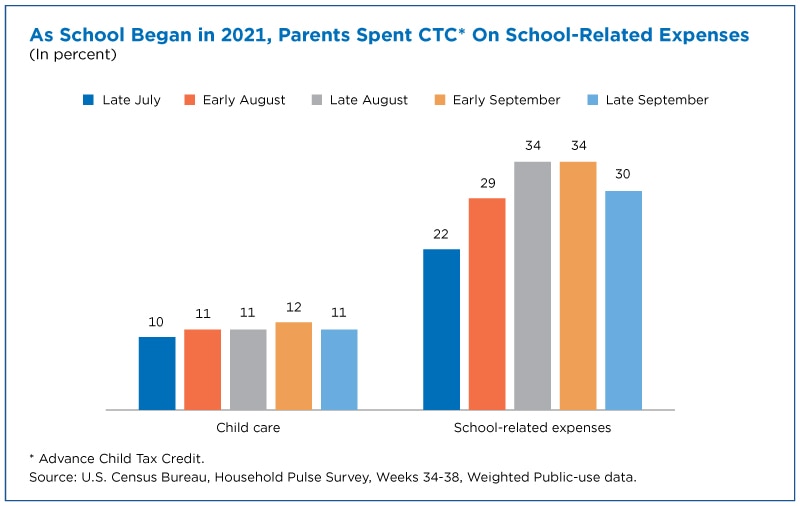

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Irs Is About To Send December S Child Tax Credit Payment January S Depends On Congress Wsj

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

Stimulus Update Some People Could See A Larger Child Tax Credit Check In December Al Com

3 7 Million More Impoverished Children Without Child Tax Credit Study

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Fifty Shades Of Whey On Twitter New Data Says Child Poverty In The Us Saw A 41 Increase From December To January This Is A Direct Result Of Getting Rid Of The

Monthly Payments For Families With Kids The 2021 Child Tax Credit United For Brownsville

Congress Votes To Increase Child Tax Credit Bring More Families Out Of Poverty Ktvb Com

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Two Ways To Boost Child Tax Credit Payments For December The Us Sun

Child Poverty Rises 41 In January A Call For Compromise On The Ctc